-

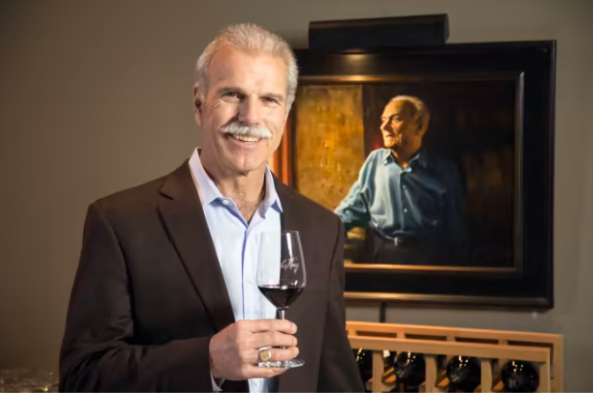

Multigenerational family wealth with Peter Mondavi Jr.

The next generation of billionaires will not be entrepreneurs but those who inherit multigenerational family wealth. “Billionaires have accumulated more wealth through inheritance than entrepreneurship, indicating that the great wealth transfer is gaining momentum,” according to a UBS study. By the numbers: In just the last year, 53 heirs have inherited $150.8 billion. By contrast, 84 new self-made billionaires created a total of $140.7 billion. That’s a lot of billions, and while that level of wealth far exceeds most people’s financial dreams, the money transfer has implications for businesses and brands whose founders don’t want to see their life’s work evaporate. “As baby boomers are well into their golden years, there…

-

Hip-hop’s impact on black businesses

The 50th anniversary of hip-hop coincides with the national Black business month in August, and the former has been a driver of growth and empowerment for the latter, according to leaders in the music genre’s industry. Hip-hop is an industry with an economic impact of $16 billion and has launched Black-owned businesses in music, film, fashion, and advertising for creatives that curated the culture. Rappers have turned into entrepreneurs, spurring growth for other Black-owned businesses, building generational wealth, and investing in the communities that nurtured them. “Hip-hop went from being a fad to commercialized and monetized in technology, fashion, sports and business,” Detavio Samuels, CEO of REVOLT, told Yahoo Finance. “In the beginning, we weren’t owners, just brand…

-

Nasdaq celebrates hip-hop’s 50th

LL COOL J rang in hip-hop’s 50th anniversary this month at the Nasdaq’s opening bell, underscoring how influential and profitable the genre has become. The bell-ringing at Nasdaq was last week, but today, August 11, is the official anniversary. An industry with an economic impact of some $16 billion, hip-hop accounts for a third of music streamed in the US, outpacing country and rock music. The genre pervades music, film, advertising, and fashion and encourages political awareness and social justice. “Nasdaq is the home of world-changing ideas that go on to be world-changing companies — part of that is culture [and] part is the business innovation,” Sehr Thadhani, chief digital officer at Nasdaq, told attendees. “The…

-

Juneteenth: High on the Hog

Honored to co-host Yahoo’s Juneteenth interview of Stephen Satterfield, host of Netflix’s High on the Hog. Part One: The meaning of “high on the hog.“ Part Two: America’s culinary tradition – Hercules and James Hemmings Part Three: The power of food to unite and teaser for season two

-

Women leaders improve profitability

As Women’s History Month comes to a close, Nasdaq had women leaders at Monday’s closing bell. With only 10% of Fortune 500 companies led by women, the symbolism of having some of the most innovative women at the intersection of finance, funding, and founding at the ceremony was not lost on attendees. “We all know that VCs are investing only 2% in female founders, and even less than that in women of color,” Shelley Zalis, CEO of the Female Quotient, said in a speech before ringing the closing bell. “But, we also know that women-led startups are outperforming their male counterparts, generating more than 63% more value and twice as much per…